What is GIPS®?

Global Investment Performance Standards (GIPS®) are ethical standards for calculating and presenting investment performance based on the principles of fair representation and full disclosure.

GIPS® strives to:

Our Investment Philosophy

Our philosophy rests on the premise that investment managers can identify and take advantage of shifts in market fundamentals and trends over time.

This tactical approach aims to maximize long-term returns while accepting short-term market fluctuations and minimizing the risk of a prolonged market downturn.

We do this by allocating a balanced portfolio of equity and fixed income investments appropriate for client risk and return requirements. We then actively select investment positions based on opportunities and trends we see developing in the market, as well as reduce investment positions when market fundamentals change for the worse and signal a downturn.

We manage money with the twin goals of protecting your capital and establishing long-term growth.

* Using this strategy, we manage over $250 million using 16 different composite portfolios that can be further customized and tailored for clients.

The objective of the Tactical Total Return Multi-Asset Balanced 50% Equity Composite is to maximize absolute long-term returns while accepting short-term market fluctuations and to minimize the downside risk of a prolonged market downturn or bear market. The tactical investment strategy combines fundamental and technical analysis to evaluate the overall status of the global markets in order to identify trends and opportunities for investment. The strategy then identifies managers or positions used to exploit the opportunities in specific markets or sectors. The strategy implements investment decisions using technical indicators to confirm market trends and buy/sell signals.

The composite may invest in multiple asset classes across the global investment universe using a balanced approach allowing for a maximum exposure of 50% equity, REIT, MLP, gold, and other pooled equity-like vehicles not to include illiquid investments and to be balanced with a range of 50% to 100% fixed income, cash, and other debt-like investments not to include alternative investments. The composite does not invest in individual equity or bond issues and invests in pooled vehicles such as mutual funds and exchange traded funds. The Tactical Total Return Multi- Asset Balanced 50% Equity Composite was created September 2017.

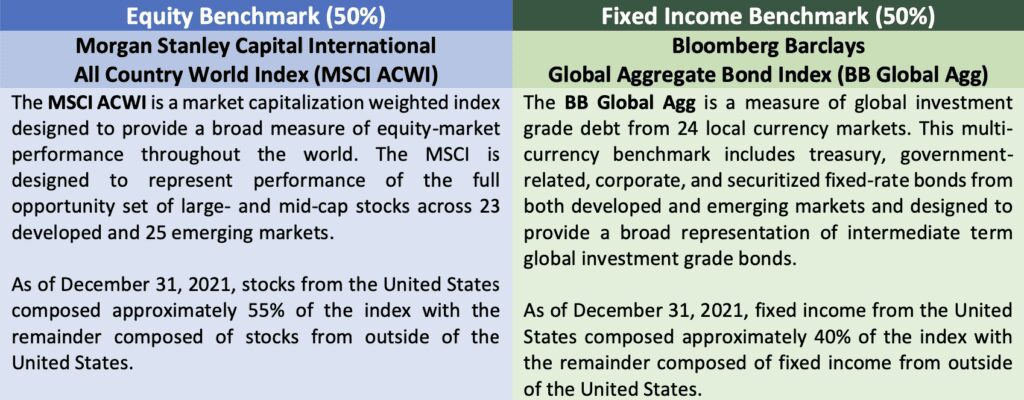

For performance comparisonsand evaluation, the Tactical Total Return Multi-Asset Balanced 50% Equity Composite is compared against a blended benchmark composed of the Morgan Stanley Capital International All Country World Index (MSCI ACWI) and the Bloomberg Barclays Global Aggregate Bond Index (BB Global Agg) in a 50/50 weighted blend. The benchmark is rebalanced monthly. Capital Growth, Inc uses a tactical investment strategy that allows for the investment into international and emerging markets. While composite investment holdings may materially differ from benchmark holdings, use of global indices are most appropriate for the composite investment mandate, objective, and strategy to seek total return across the global investment universe.

Capital Growth, Inc. claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this report in compliance with the GIPS standards. Capital Growth, Inc has been independently verified for the periods January 1, 2005 through December 31, 2018.

A firm that claims compliance with the GIPS standards must establish policies and procedures for complying with all the applicable requirements of the GIPS standards. Verification provides assurance on whether the firm’s policies and procedures related to composite and pooled fund maintenance, as well as the calculation, presentation, and distribution of performance, have been designed in compliance with the GIPS standards and have been implemented on a firm-wide basis. The Tactical Total Return Multi-Asset Balanced 50% Equity Composite has had a performance examination for the periods January 1, 2005 to December 31, 2018. The verification and performance examination reports are available upon request.

GIPS® is a registered trademark of the CFA Institute. The CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein.

The investment management fee schedule for the composite is tiered at: 1.20% on the first $500k; 0.80% from $500k, to $2 million; and 0.60% on amounts over $2 million. While the fee schedule is negotiable, the firm’s maximum permitted fee schedule is: 1.5% on the first $500k; 1.4% from $500k to $1 million; and 1.2% on amounts over $1 million.

Results are based on fully discretionary accounts under management, including those accounts no longer with the firm. The currency used to express performance is the US Dollar ($). Returns are presented gross and net of management fees and include the reinvestment of all income. Net-of-fee returns are reduced by trading costs and each portfolio’s actual investment management fee. The annual composite dispersion presented is an asset-weighted standard deviation calculated for the accounts in the composite the entire year. Policies for valuing portfolios, calculating performance, and preparing compliant presentations are available upon request by contacting Matt Belardes, CFA® at matthewb@capitalgrowthinc.com or by calling (800) 445-1048. Past performance is not indicative of future results. No investment strategy can guarantee a profit or protect against loss.

To view the complete report, policies and procedures, and verification letter, click here.

PAST GIPS PERFORMANCE REPORTS

Looking to see our past performance? As GIPS Compliant Financial Advisors, we’re happy to share all GIPS performance reports from the last two years.