After weeks of headlines about the coronavirus outbreak, markets have been caught in a volatile pattern of surges and retreats. Here’s what you should know:

Why are markets so volatile?

Disease outbreaks are hard to predict and come with a great deal of uncertainty that can make investors nervous—particularly after a period of record market gains.

As the epidemic spreads beyond China, investors worry that it could cause serious disruptions to trade and the interconnected global economy.

How long will the volatility last?

It’s hard to say. Though the human cost of an outbreak like Coronavirus is tragic, it’s unclear how widespread the economic fallout will actually be. We can’t predict what markets will do, but this isn’t the first time we’ve grappled with market reactions to an epidemic.

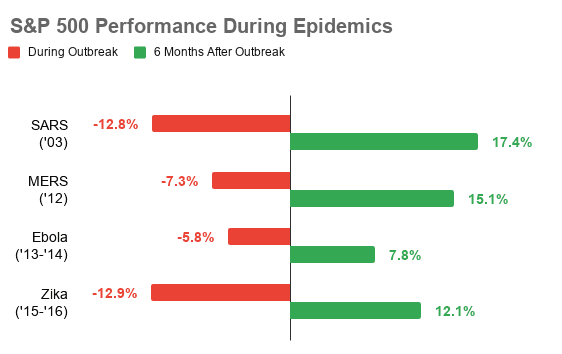

Here are some examples from previous outbreaks:

Though the past can’t predict the future, we can see that historically, markets reacted to epidemics with panic selling, but recovered after the initial outbreak.

However, epidemics don’t happen in isolation; the underlying economic and market fundamentals will influence how investors react long-term.

Pullbacks and periods of volatility happen regularly, for many reasons.

Whether the cause is an epidemic, geopolitical crisis, natural disaster, or financial issue, markets often react negatively to bad news and then recover.

Sometimes, the push-and-pull can go on for weeks and months, which can be stressful, even when it’s a normal part of the market cycle.

The best thing you can do is stick to your strategies and avoid emotional decision-making. Why?

Because emotional reactions don’t lead to smart investing decisions. The biggest mistake investors can make right now is to overreact instead of sticking to their strategies.

We’re keeping an eye on how the epidemic may affect our clients and will be in contact if adjustments to your strategies need to be made.

Reading too many headlines? Having trouble keeping calm? Just give us a call at 858-552-6960 and we’ll be happy to help. That’s one of the biggest benefits of working with an advisor—a reassuring voice on the phone when you’ve got concerns to share.

DISCLOSURES

Chart Source:

S&P 500 performance during outbreak: https://www.cnbc.com/2020/02/24/avoid-this-investing-mistake-as-coronavirus-fears-grip-the-markets.html

S&P 500 performance six months after outbreak: Yahoo Finance. 6-month performance between open of first trading day of the month after end of outbreak to adjusted close of final trading day of the sixth month.

SARS: April 1, 2003 – Sept 30, 2003

MERS: Dec 3, 2012 – May 31, 2013

Ebola: March 3, 2014 – Aug 29, 2014

Zika: March 1, 2016 – Aug 31, 2016

Risk Disclosure: Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Past performance does not guarantee future results.

This material is for information purposes only and is not intended as an offer or solicitation with respect to the purchase or sale of any security. The content is developed from sources believed to be providing accurate information; no warranty, expressed or implied, is made regarding accuracy, adequacy, completeness, legality, reliability or usefulness of any information. Consult your financial professional before making any investment decision. For illustrative use only.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance. The Standard & Poor’s 500 (S&P 500®) is an unmanaged group of securities considered to be representative of the stock market in general. Indexes are not available for direct investment. The performance of the index excludes any taxes, fees and expenses.

Registered principal offering securities and advisory services through Independent Financial Group LLC (IFG), a registered broker-dealer and investment adviser. Member FINRA & SIPC. Advisory Services through Capital Growth, Inc. (CGI). CGI and IFG are not affiliated.